The cryptocurrency market is volatile and can be challenging to master. This article will walk you through the process of trading cryptocurrencies on eToro, a popular online broker.

The how do i sell crypto on etoro is a question that has been asked quite often. In this guide, we will go over how to trade cryptocurrency on eToro.

eToro gives you exposure to bitcoin trading while also providing you with social trading capabilities. Learn from genuine professionals while automating your trading approach.

Trading cryptocurrencies on eToro is simple for novices, and social trading allows you to profit by imitating experienced traders. We’ll go over everything you need to know about eToro trading, including how to submit a trade and how to imitate other traders.

- BTC, ETH, XRP, LTC, BCH, XLM are all available cryptos.

- Credit/Debit Card, Neteller, Skrill, Transfer of Information via Wire, and Other Deposit Methods

- GBP and USD are accepted currencies.

- Email, Facebook, and eToro Friends support

- Costs: There are daily fees.

What Is eToro and How Does It Work?

eToro is a CFD broker that has been the world’s largest social trading network for a decade. It was founded in 2007. eToro recognizes the value of cryptocurrencies and currently offers trading on nine different cryptocurrencies.

Not only will eToro’s 6 million registered users be able to trade cryptocurrencies, but it will also provide prospective cryptocurrency investors with an intriguing venue to acquire exposure to these assets.

Terminology on TotalCrypto.io

CFD is an abbreviation for ‘Contract For Difference.’ In a nutshell, this implies you won’t have to store or own bitcoin directly. Instead, you purchase and sell contracts backed by the cryptocurrency you’re investing in.

This means you may have all of your exposure to the cryptocurrency market with just one account and don’t have to worry about complex storage issues.

eToro is not only completely regulated, but it also enables you to replicate the bitcoin portfolios of the platform’s most successful traders. This feature is very helpful to many people, and it distinguishes eToro from the competition.

eToro’s Advantages

- On a completely regulated platform, get exposure to cryptocurrencies.

- Excellent client service.

- There’s no need to keep your bitcoin holdings in crypto wallets. As a result, you may concentrate only on making successful choices.

- You may replicate the portfolios of successful traders via social trading.

Facts about eToro

- Etoro has a long track record, having been founded in 2007.

- Popular – eToro offers a sizable trading community, with over 6 million registered members.

- eToro is Unique – eToro is unique in that it offers social trading opportunities. You will be able to see and follow the strategies of trading experts. Thousands of people follow these expert traders on eToro.

- Insurance – The Financial Services Compensation Scheme covers eToro balances. This implies that client balances are covered for up to £50,000 in the event of a disaster.

- Deposit Methods – The following deposit methods are supported, and the minimum deposit limit varies between $200 and $500 depending on the method:

- Credit/debit cards (Visa, Mastercard, Diners Club), Neteller, Skrill, and Webmoney are all acceptable methods of payment.

- Union Pay in China

- Giropay (Sofortüberweisung) is a payment method that allows you to send money quickly.

- Webmoney

- Yandex

- Wire Transfer

- Deposits – For unverified accounts, the maximum deposit is €2,000.

- Ripple, Dash, Neo, Ethereum, Stellar, Bitcoin, Ethereum Classic, Bitcoin Cash, and Litecoin are all tradeable cryptocurrencies.

- eToro does not provide any leverage for crypto trading.

- eToro Friends, Facebook, and email are all options for customer support.

Like the idea of copying the crypto portfolios of successful investors? Get Started With eToro Right Now!

The CySEC and the FCA are in charge of regulation.

RISK WARNING: YOUR CAPITAL MAY BE IN JEOPARDY.

Before we get into particular trading features, let us take you on a tour of eToro. Following the creation of your account, you will be provided with the dashboard page shown below. Take a look at the images below to learn more about each of the sidebar choices.

Watchlist

Your ‘Watchlist,’ which is a collection of markets you monitor on a regular basis, is the default display screen. You may add markets to this list by scrolling down and using the “+ADD MARKETS” button. A pop-up window will appear, from which you may choose “Crypto.” After that, you’ll get a list of trading cryptocurrencies that you may add to your watchlist.

As of March 2018, the following cryptocurrencies are available for trading on eToro:

- Bitcoin Cash (BCH) is a cryptocurrency that (BCH)

- Bitcoin is a digital currency (BTC)

- DASH (pronounced “dash”) is a (DASH)

- Ethereum Classic (ETC) is a cryptocurrency that (ETC)

- Ethereum is a cryptocurrency (ETH)

- Litecoin (LTC) is a cryptocurrency that was launched (LTC)

- NEO is an acronym for “New Economy Organization” (NEO)

- Excellent (XLM)

- Ripple effect (XRP)

By default, your list will only include two cryptocurrencies (Bitcoin and Ethereum) as well as other equities, commodities, currencies, and other financial instruments. You may delete items from this list by clicking on the one you wish to remove, then selecting “My Watchlist” from the checkbox option in the top-right corner.

In addition, if you click the “Add to new list” button, you will be given the option of creating a new list. If you trade more than simply cryptos on eToro and wish to split your lists appropriately, this option is ideal.

Markets aren’t the only thing that can be added to a watchlist…

You’ll find a section where you may monitor “People” if you scroll down. Below your current list, you’ll notice a “+DISCOVER PEOPLE” button. When you click this button, you’ll be sent to the “People who copy” tab (another sidebar option). This section of your watchlist, however, will not just show individuals; it will also show any CopyFunds you choose to follow.

Treat your dashboard’s watchlist area as a method to maintain tabs on the different crypto marketplaces. Use it to keep track of the performance of different cryptocurrency traders and investment funds.

Because it’s still a young business, newer eToro members may be very lucrative. You can’t rely on someone with no background to imitate you. Instead, after a trader has established a track record, you may add them to your portfolio from your watchlist.

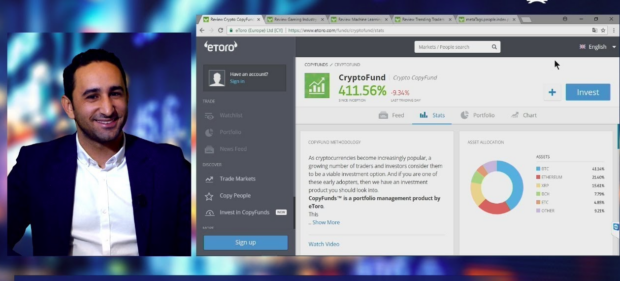

CopyFunds vs. People

Individuals having public eToro profiles are referred to as “people.” You’ll see their news feed, bio, and follower count when you click on them. The “Stats” page displays a month-by-month and year-by-year analysis of their trading performance.

The trader’s portfolio, which includes open positions, entry points, amounts invested, and profit/loss, is shown under the “Portfolio” tab. The “Chart” tab shows a graph that represents the results you would have seen if you had invested $10,000 in the trader.

CopyFunds are themed portfolio management solutions that allow you to operate as your own “hedge fund” (even Berkshire Hathaway can be copied here).

These portfolios provide you with more diversification, which is a simple method to ensure that you have full exposure to the crypto market. Crypto markets have few choices, although there are a few, such as “CryptoFund” (several currencies) and “Crypto-currency” (BTC/ETH).

Portfolio

The Portfolio tab displays a page that allows you to keep track of all of your open trading positions. To start trading, you must first complete your profile and make a deposit; otherwise, nothing will appear here. Any duplicated transactions and manually created positions will be shown in the Portfolio section.

You will be able to see the following:

- You’re trading in a market (the particular crypto)

- Purchased/sold units

- Invested amount

- Profit after taxes

- Percentage of profit/loss

- Value at the moment

This area has a lot of options and filters. You may look at your trading history, check pending orders, and share through social media, among other things. Your portfolio may also be publicized across eToro if you’re popular enough, with the goal of encouraging others to imitate your moves.

News Feed

eToro is a platform for social trading. Their “News Feed” portion works in a similar way to a social networking platform. People may share their ideas as well as technical analyses. You may look up particular cryptocurrencies and see what other people have to say about them.

Don’t make investments purely on the basis of research given by users in your news feed. If the stocks in someone’s portfolio pique your attention, you may visit their profile to view their trading history and add them to your watchlist or replicate their portfolio.

Markets for Trade

This link will take you to a part of the eToro site that lists all of the various trading markets accessible. The first choice is “Crypto,” which will display the nine presently traded cryptocurrencies. For each, you’ll see the current buy/sell price as well as the % change from the previous day.

Bitcoin would cost $8,343.58 to purchase, as seen in the picture above. If you wanted to sell, the price per coin would be $8,180.04. There is a $163.54 spread at the present price, which implies your cost to start and exit the trade is approximately that much.

Before you start trading, be sure you’ve calculated your trades.

At such prices, a $163.54 spread implies a nearly 2% open and close charge. For you to liquidate your trade at a profit, the price of Bitcoin would have to move in your favor by more than 2%.

If the transaction goes against you, you’ll lose the value of the transfer plus the two percent commission you paid to do it.

From this area of your dashboard, you may open a position by clicking the “Buy” or “Sell” button for the coin you wish to trade. For additional information, see the section below under “How to Trade Cryptocurrencies on eToro.”

Note: On eToro’s “Market Hours & Fees” page, you can see that Bitcoin has a 1.5 percent spread while Ethereum has a 2 percent spread.

They do say, however, that “the spreads are the minimum spreads and are not guaranteed.” Since a result, you should always manually calculate the spread before taking a trade, as the spread tends to expand when the relevant crypto’s price is volatile.

Trading high-spread coins (BCH, ETC, XLM – all have 5% minimum spreads) isn’t recommended since you’ll be trapped holding your transaction for a long time before making a profit. In fact, if you’re copying someone who trades them, you should just take on their other positions.

Copy People

Here you may discover individuals who have had success trading and replicate their portfolios to help you automate your trading approach. Choose “WHO INVEST IN” from the dropdown menu, then “Crypto” from the bottom of the list. On eToro, you will now see a library of crypto traders.

We suggest changing the “GAINED AT LEAST” option to “100” for optimal results, since crypto trading has a large profit potential. You’ll see that this offers you a variety of traders with returns of 100% or more. Some traders have made returns of 400 percent or more. We also recommend setting the minimum copier count to HIGH (above 500) so that you only replicate deals that others are happy with.

Invest in CopyFunds if you want to make a profit.

This section will introduce you to a few bitcoin portfolio fund alternatives. eToro does not presently display them by default; you must search for cryptocurrency and choose from the choices that appear. You may, for example, clone “CryptoFund” and invest in a variety of cryptocurrencies.

The absence of human administration needed while investing via a CopyFund is a significant advantage. These portfolios are managed by expert traders, and regardless of how long you keep them, you may participate without paying any management costs.

How to Trade Crypto at eToro

You may initiate a transaction from your dashboard’s Trade Markets or Watchlist sections. To open a position on a certain cryptocurrency, go to Trade Markets and click “Buy” or “Sell.” Press “S” to open a short and “B” to open a long in the Watchlist area. Alternatively, if you go to a cryptocurrency’s information page, you may choose whether you wish to purchase or sell by using the “Trade” button.

Note that eToro does not yet provide anything more than 1x leverage or a stop loss mechanism.

To trade:

- Enter the amount you’re willing to take a chance on.

- Choose a “Take Profit” option (1000 percent maximum)

- Press the “Open Trade” button.

Once you’ve placed your order, eToro will process it and your position will become live. You may also choose “Order” from the “Trade” dropdown menu.

You may then decide where you will start a trade (long or short) if the price hits that level. When day trading crypto at eToro, this tool is critical for optimizing your earnings.

Not sure where to put your orders to obtain the greatest potential spot? Learn how to plan your entry points by reading our technical analysis tutorial for beginners.

In your Portfolio page, keep track of your newly opened job. From there, you may utilize the gear icon to access a variety of settings. You have the option of closing the transaction, writing a blog post about it, seeing the chart, or setting a price alert.

Because stop-losses aren’t accessible on eToro, we suggest using the price alert feature and manually closing your trade when the market hits your desired stop price.

Trading seems to be a difficult task. Where Can I Find Assistance?

When it comes to trading, there is a high learning curve, so we’ve put together a few tools to help you get started.

Before you make your first transaction, it’s critical that you understand what you’re doing. After all, this is actual money. Remember the golden rule: you should never invest money you can’t afford to lose.

- BTC, ETH, XRP, LTC, BCH, XLM are all available cryptos.

- Credit/Debit Card, Neteller, Skrill, Wire Transfer, and Other Deposit Methods

- GBP and USD are accepted currencies.

- Email, Facebook, and eToro Friends support

- Costs: There are daily fees.

Conclusion

The social trading characteristics of eToro set it apart from the competition. TotalCrypto likes the concept of learning from experienced cryptocurrency investors, copy trading, and how simple it is to get started with bitcoin on eToro. Certainly, the platform is well-designed and user-friendly.

However, having additional cryptocurrencies to select from would be great, and we hope that eToro will expand the amount of cryptos available. The spreads on Bitcoin Cash, Ethereum Classic, and Stellar are too wide for us, and we believe there are better ways to trade these cryptocurrencies. Overall, we are pleased to suggest eToro to TotalCrypto customers, and believe it is one of the most powerful bitcoin CFD brokers available.

Further Reading – eToro Offers 3 Cryptocurrencies for Investing:

[ratings]DISCLAIMER: The activity of the cryptoassets discussed in this paper is uncontrolled. This post is not intended to provide financial advice. Always do independent research.

The how to close a trade on etoro is a walkthrough guide that will teach you how to close your position and exit the market.

Frequently Asked Questions

How do you trade cryptocurrency step by step?

There are many different ways to trade cryptocurrency, but the simplest way is to first purchase some Bitcoin or Ethereum with your local currency. Once you have some cryptocurrency, you can then exchange it for other cryptocurrencies like Litecoin, Monero, or Zcash.

Can I day trade Crypto on eToro?

Yes, you can day trade Crypto on eToro.

Is eToro good for Crypto trading?

eToro is not a good platform for crypto trading. It does not offer the best prices or liquidity, and it has many other drawbacks.